Are you ready for April 15?

If not, we are here to assist you with everything about Tax Day USA.

It’s crucial to prepare for tax season whether you are a business owner or an employee. This will keep you on track of everything – with accurate data and on-time filing. Hence, it’s critical to examine all the necessary information before the big day.

Here we have shared all the information and updates that you may need to stay prepped. It will cover topics like – how to acquire documentation, current tax changes, and the consequences of missing deadlines for filing income tax returns that have been received.

All Aboard and Ready?

Before we proceed, let’s have a look at what taxation is!

What Is Federal Income Tax?

Allow me to break it down in simple terms. Income taxes are collected by the International Revenue Service (IRS) on behalf of the United States government. The annual income of people, companies along other entities is the basis of these taxes. This covers a range of revenue streams such as salaries, revenues from investment wages, and other kinds of income.

The deadline to make your tax payments and file your personal Income Tax Return (ITR) to the Federal government is Tax Day in the United States.

Eager to know more about Tax Day USA? Keep reading!

What Exactly is Tax Day? Let Us Explore!

We consider Tax Day to be the final date for tax payments and individual federal tax returns.

Do you know? In the United States, Tax Day falls on April 15 each year. If the day falls on a holiday or weekend, it is considered a business day.

Likewise, in 2024, Tax Day falls on April 15. Most states consider the same date as the deadline to file state income tax. The tax season in the USA runs between January 1 and April 15, during which you can file taxes or pay them for the previous year.

Let us look at some of the noteworthy points for your quick knowledge:

- Tax Day is the payment deadline for filing income tax returns that have been received. The Federal government has set the Tax Day 2024 USA as April 15.

- If Tax Day falls on any holiday and weekend, the IRS expands its date.

- If you are not able to meet the deadline for tax payment, you can freely file for a tax deadline extension of 6 months. However, note that you still need to pay the tax you owe by the revised deadline.

Now that you have gained a little idea about Tax Day 2024 let’s have a look at some essential facts below.

Tax Day 2024: What You Need To Know?

As you have learned about the deadline for filing income tax returns that have been received by all taxpayers, we will now have a look at certain factors that are important to consider before filing taxes:

1. Who must file

- You can file a return by Tax Day if you are earning income or your income gets deducted from your paychecks.

- This applies to small business owners as well as self-employed individuals. They can file to pay estimated taxes quarterly and reconcile annually.

2. Retired Adults

- As a retired adult, it is important for you to file income taxes by Tax Day. It considers certain sources of income such as investments, pensions, social security, and retirement account withdrawals.

3. Some Important Reminders:

- Do you need some additional time to make ready your tax return? Choose the option to appeal for a tax deadline extension.

- You must remember that your tax payment is due on the actual Tax Day.

- Take the help of the IRS Free File tool for filing an extension. Make sure to incorporate the estimated payment with the form.

- You are resilient enough to pay the part or total estimated tax bill while filing for a tax deadline extension. Remember to specify that your payment is intended for extension.

- Time is an important factor while you file your extension. Ensure you file the extension request on the Tax Day 2024 USA date or before it. Otherwise, you will be penalized for late fees.

I can assure you that after you become knowledgeable about the above information and steps, you can manage all your tax obligations evenly as per the state and federal requirements.

Do you know the history behind the emergence of Tax Day in the USA? Before you go through your tax obligations, have a look at the background below:

Background of Tax Day

- According to research guides, in 1861, the United States brought in income tax to hold up the American Civil War effort. However, in 1872 it was considered unconstitutional.

- In 1894, taxing personal income reappeared with certain legal uncertainties.

- In 1913, the modern income tax system was established and has been confirmed by the 16th Amendment to the US.

- Tax Day 2024 USA has changed over time, which was initially set on March 1, 1913.

- In 1955, Tax Day was set on April 15, and it remains unchanged to date.

If your interest lies in learning more about Tax Day, you must know about the filing of federal income tax.

Below is a detailed discussion for your understanding!

How To File Your Federal Income Taxes?

With IRS regulations, you can get various options regarding the filing of your income taxes. You can work with a tax professional or utilize a tax preparation software.

There is software called Free File Program by the IRS which you can use as an economical and convenient service.

Find below some crucial points to consider:

1. Eligibility

- According to the guidelines, if you earn $79,000 or less as an Adjusted Gross Income (AGI), you can get into tax preparation services with the help of a partner site.

- If your income is more than $79,000, you can easily prepare taxes online without any cost as per tax brackets 2024.

2. Electronic Filing (E-filing)

- I suggest you opt for e-filing as it accelerates the refund process. It can help you get the refunds within 3 weeks of the 2024 tax refund schedule when the IRS receives their return.

- As an alternative, you can mail a paper return to the IRS; however, it may take about 6 to 8 weeks to process.

3. Additional Services

- There are various services by IRS to help taxpayers which include Tax Counseling for the Elderly (TCE) program and Volunteer Income Tax Assistance (VITA).

- With this program, you can get free basic tax return preparation that adds valuable support during tax season.

Okay, so now you have understood the process of income tax filing following the IRS regulations. But what if you miss the deadline?

Below, I have referred to certain outcomes of it to help you go as planned in the future.

Missed Deadline? Know the Consequences!

1. Failure-to-file penalty and Refunds

Once you miss the deadline it is crucial to file your return quickly to get rid of failure-to-file penalty. In case, you are eligible for a refund, IRS will not impose any penalty.

Don’t forget, there is a 3-year rule of limitations on refunds. Filing over this time frame may forfeit your refund.

2. Failure-to-pay Penalty and Interest Charges

If you miss the payment deadline, you may be exposed to a failure-to-pay penalty along with other interest charges on the amount. Certain exceptions may be allowed, such as if you are going through any financial hardships, given that you file for a tax deadline extension.

Thus, always try to file your taxes as soon as possible. Upon receipt, start gathering your documents promptly. If you want to engage a tax professional, make sure to schedule an appointment in advance. This approach can assist you in your financial planning.

As you go through the complexities of filing income tax, I would suggest you stay informed about the latest updates that are issued by the IRS for the Tax Day 2024 USA schedule.

Here you go!

Bigger Tax Refunds in 2024

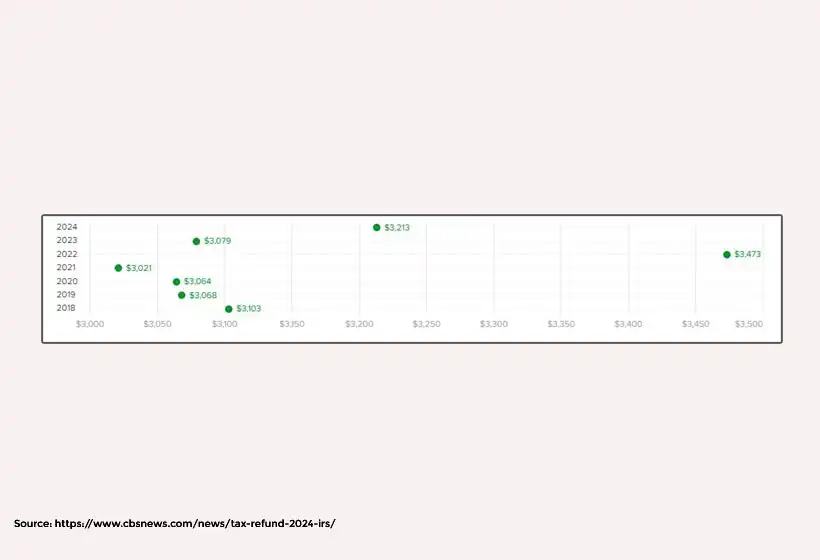

As per reports and data of February 2023, the tax refund was $3,213 which marks a 4% growth from the average refund.

There is a surge in the average refund size that is credited to the IRS for its adjustment of tax provisions for inflation. Note that the tax brackets and the standard deductions were all set at 7% higher for the tax year 2023, the time for which you are now filing the taxes.

Recent Tax Adjustments

- Inflation Impact

Strong inflation of 2022 has caused some notable adjustments to the tax code for the year 2023. These variations are directed towards accommodating the impact of inflation on the taxpayers.

- More Generous Standard Deductions

Because of the adjustments, you can get a more generous standard deduction. This indicates that a large portion of your income may not be subjected to taxation.

- Increased Earned Income Tax Credit (EITC)

The maximum amount that you can claim as a tax filer for the Earned Income Tax Credit has been increased. If you are a low or moderate-income individual, you can get additional support in this Tax Day USA.

- Higher-income threshold

You may be pleased to know that there is an increase in the income threshold at which tax rates take effect. Thus, more income may be subjected to a lower tax rate, which will help you reduce your tax liability.

Now, you have a clear idea about the recent tax adjustments made by the IRS. It is also important to know your tax obligations if you are a small business owner.

Are you a small business owner? Let us look at certain tips to help you prepare for the Tax Day 2024 USA schedule:

Tax Day USA Tips for Small Business Owners & Start Up Companies

1. Maintain Detailed Records

- Keep an organized record of all the business transactions. This vital practice helps you to calculate your taxes accurately and substantiate all your tax obligations.

- Make use of any accounting system or software for an efficient bookkeeping process.

- Always confirm that you have all the records of receipts, invoices, bills, sales slips, and other financial documents associated with your business.

2. Understand Your Business Entity

- Your business is unique like your tax position. The type of business you operate affects your tax responsibilities.

- To learn more precisely about the particular requirements of your business entity, consult a tax professional or an accounting expert.

- Keep yourself updated with any modifications in the tax regulations that might have an impact on your business operation.

3. Consult a Tax Professional

- You can get assistance with the complexities of tax regulations and laws from an accountant or tax specialist.

- Ask for their help in devising tax plans that are beneficial for your company.

- Before making any important decisions about tax preparation and your business structure, you must consult a tax professional.

Your ability to pay your taxes on time will determine how well your business works. Even while it may seem difficult, it can be simpler with careful preparation and planning.

4. Maintain Your Tax Documents

Though your tax situation may vary, the following standard documents are necessary to facilitate a seamless tax season:

- Gross Receipts:

Records all the income sources, such as sales records, invoices, cash register tapes, and 1099-MISC forms.

- Purchases:

Keep records of all items purchased which includes the descriptions of the items, amount paid, and payee. Try to keep records of the items you resell and buy, which may include the parts or materials you use for the production of finished products. This will help you pay your taxes as per Tax Day 2024 USA dates.

- Expenses:

Keep a record of every item your company incurs, such as utilities, rents, office supplies, and receipts.

- Travel, Transportation, entertainment, and Gifts:

When claiming deductions for expenses related to travel and transportation, make sure you have supporting documents. It proves that the expenses are related to your business.

- Asset:

Managing a business requires management of various properties like furniture, machinery, and more. It is not easy to keep track of all the assets. It is necessary to keep thorough records to manage this efficiently. This includes documents like purchase and sales invoices, evidence of payment, and real estate closing statements.

When you decide to sell any such assets, these records remain crucial for determining annual depreciation.

- Employment Taxes:

If you hire employees, you must maintain certain records for employment-related taxes. In addition to other tasks, you will need to keep track of your pay rate. These records include documents that list your pay rates, any benefits you offer, and the amount of money deducted.

To ensure you are fulfilling your tax duties as per Tax Day 2024 USA schedule and accurately, it is crucial to maintain records in an organized manner.

The specifics of your tax obligations can differ depending on the business type, though keeping records is similar for all types of business.

Do you live in Minnesota? Then you must be aware of 3 tax law changes!

If not, know before you file your taxes!

Top 3 Tax Law Changes in Minnesota

Rebate Checks and IRS Taxation

- According to the latest report, in Minnesota, almost 2.1 million people are eligible for a one-time refund cheque. For single taxpayers, the rebate is $260, and for married couples, it is $520. Up to three dependents may receive an additional $260 each.

- Married couples making less than $150,000 annually and other taxpayers making less than $750,000 annually are among the qualifying groups.

- Although there will be no state taxes owing to these payments, Minnesotans will owe the IRS taxes due to the rebate approval related to the federal COVID emergency expiration.

- Depending on the rebate amount received, you can anticipate paying an IRS tax of between $26 and $286 within the Minnesota tax filing deadline of 2024.

Child Tax Credit

- Democrats implemented the Child Tax Credit to reduce child poverty in Minnesota.

- According to the previous report, if your family makes over $35,000 per year, the $1,750 credit per child phase-out.

- Higher-income families can still qualify for a smaller credit depending on their number of children and income.

- Note that, for some families with 3 children under the age of 18, there is a modification of the working family credit under the new tax law. It includes a maximum credit of $5,600.

- This benefit will affect about 265,000 families, including those who do not oblige legally to file taxes.

Social Security Tax Cuts

- As per the report mentioned above, beginning with the 2023 tax year, there is no requirement for the retired couples earning up to $100,000 and individuals earning up to $ 78,000 to pay state taxes on their social security income.

- With this bill, following the Tax Day 2024 Minnesota calendar, the percentage of seniors whom state taxes has exempted from social security benefits will rise from 50% to 76%.

- Bipartisan agreement in 2022 eliminated the state’s tax on social security benefits. However, they revise the matter in 2023 session due to changes in the law.

These programs are the first step towards giving you and your families access to help and financial relief. Knowing these provisions can help you make financially responsible judgments as tax season progresses.

You may get amaze to hear that many American taxpayers have a variety of complaints about the tax system. One of the complaints is that there lies a burden on those with middle and lower incomes more than those with higher incomes.

How about knowing the features of the tax code that are fundamentally wrong? Let us explore!

What’s Wrong With the American Tax System?

1. Taxpayer Sentiment

According to an IRS survey conducted in 2021, the majority of Americans believe that paying taxes is their civic obligation. Some factors that determine a decrease in trust and satisfaction with the IRS include education level, age, and other political affiliations.

Political Party affiliations are important, with Republicans having more optimistic opinions and Democrats getting more doubtful, particularly amid the 2017 tax cuts.

2. Views of Taxation

The majority of the taxpayers agree that taxes are necessary to pay for government activities. However, they have different opinions about the size and funding level. Debates center on the optimal way to set up the tax system, the effective tax rate, and how it affects different social groups.

3. Biden’s Attempts at Tax Change

According to the report, to stop big businesses from avoiding taxes, the Inflation Reduction Rate (IRA) of 2022 imposes an alternative corporate minimum tax of 15%. Over the next 10 years, the IRA will provide $80 billion in money to improve customer service, enforcement, and personnel levels at the IRS.

Despite bipartisan support, opposition persists, especially in the light of the possible rise in IRA audits of regular taxpayers.

4. Fair Distribution of Tax Burden

There are certain issues regarding the fairness of tax loads due to the argument made by the critics that the current tax system is not sufficiently progressive. The large businesses and wealthy people avoiding substantial tax obligations undermine public trust in the system.

The target of the alternative corporate minimum tax is to address tax evasion by large firms which reflects worries about the unequal distribution of tax burden.

As Tax Day 2024 USA approaches, it is critical to consider recent tax changes and taxpayer sentiment. Along with that, it is also crucial to ensure that you have taken all the required actions to complete your tax obligation. Being proactive and organized can substantially ease the process and help to avoid potential penalties.

Make sure Tax Day does not sneak up on you. Today, take charge of your finances and file with confidence!

FAQs on Tax Day

- Is Tax Day always on April 15?

Your federal Individual Income Tax Return is due on April 15 if your tax year ends on December 31 and you file your taxes yearly using the Tax Day 2024 USA calendar year.

- What is Tax Day in the USA?

The deadline for filing income tax returns that have been received by the federal government is Tax Day in the United States. This day observed since 1955 usually falls on April 15.

- What happens if you miss the April 15 tax deadline?

If you don’t request a tax deadline extension and you don’t file your taxes on time, they will penalize you. It will also charge daily interest to the entire amount including penalties.

- Can you submit taxes on April 18?

There won’t be any penalties if you file your taxes after the deadline on April 18 as long as you qualify for a refund. You can use IRS.gov to obtain the IRS Free File until October 16.

- When to expect a tax refund with child credit 2024?

According to the report, as per the IRS, most 2024 tax refund schedules for the child tax credit and earned income tax credit will be available in bank accounts by February 27th for taxpayers who have filed and chosen direct deposit.